Make Eurasia Great Again

What began as Trumpian economic warfare has become global realignment—with Britain, China, and the EU emerging more agile than expected.

As Trump launched his so-called “liberation day” with sweeping tariffs on U.S. trading partners, the global economic weather has turned turbulent. The $3 trillion wealth wipe-out and the onset of a full-scale trade war are reshaping international economic alliances, with unexpected potential winners emerging: the United Kingdom, China, and the European Union.

The UK, spared the worst of Trump's arbitrary tariff formula, now finds itself with a comparative trade advantage, renewed investor interest, and a theoretically open path to a new trade deal—though political and regulatory hurdles loom large. China, demonized by MAGA nationalists, is responding with strategic diversification and strengthened regional alliances, potentially lowering global inflation and accelerating its rise as a tech and infrastructure leader. Meanwhile, the EU is signalling a shift away from U.S. alignment, exploring revived cooperation with China through a thawed Comprehensive Agreement on Investment (CAI), and leveraging Trump’s trade aggression as justification for long-sought strategic autonomy.

In sum, while the U.S. lashes out with chaotic protectionism, its rivals are adapting—quietly forging new trade paths, recalibrating alliances, and in some cases, turning Trump's war into their own opportunity.

1. Trump Tariffs impact on the United Kingdom.

In the United Kingdom’s case, His Britannic Majesty’s government got off lightly. This is largely due to the nonsensical nature of the Trump administration’s approach to “reciprocal tariffs.” It ignored trade in services entirely, fixated solely on trade deficits in goods, and completely overlooked the actual tariffs other countries impose on U.S. exports. In short: a nonsense maths equation. And because the UK’s trade surplus with the United States lies in services, not goods, three things now stand out.

First, comparative tariff advantage. The UK has been hit with a 10 per cent tariff on its exports to the U.S.—relatively modest compared to most others. Chinese goods, for example, now face an accumulative tariff rate of 54 per cent. This smaller tariff burden could make British products more competitively priced in the U.S. market than those from nations facing steeper barriers.

To underscore the point: in recent years, UK goods exports to the U.S. have lagged behind eurozone competitors. But now, with a 10 per cent tariff versus the eurozone’s 20 per cent, British exporters are better positioned to compete across the Atlantic.

Second, attractiveness to investors. Trump’s tariff blitz has made U.S. markets less predictable—something investors universally dislike. When instability reigns, money flows to the safe harbours, where rules are clearer and shocks less frequent. Cavendish, a UK-focused investment bank, predicts these circumstances could boost UK equities, as investors look for markets less entangled in Washington’s trade warfare.

Third, the elephant in the room: potential trade negotiations. In response to the tariff impositions, the UK government is actively pursuing a trade agreement with the U.S. to soften the blow. But unlike the two points above, there are substantial grounds for scepticism here.

Business Minister Jonathan Reynolds has admitted it’s “not inaccurate” to say the two sides have agreed on the broad outline of a deal—possibly securing a carve-out on tariffs. However, while Britain has been pushing for a narrow, tech-focused agreement, Republican lawmakers are demanding greater access to UK agricultural markets. Given America’s notoriously lax regulatory standards—not to mention its fondness for hormone-injected beef and chlorinated chicken—a British concession in this area seems highly unlikely.

Even more problematic are U.S. demands related to tech, artificial intelligence, and a loosening of regulations around social media and cultural content. Colour me sceptical, but the odds of a UK government—especially a Labour one—making meaningful concessions on these fronts are vanishingly slim

Here is a quick summary on MSNBC by investor, commentator and former journalist Steve Rattner

2. Trump Tariff Impact on China.

No other country draws out the full force of ultra-MAGA nativist ire quite like China. Vice President J.D. Vance’s defence of America’s new global trade war came in the form of a bizarre, unhinged rant against “globalists” and “Chinese peasants”—a short clip packed with more inaccuracies than a supermarket tabloid.

Ironically, that very ignorance may end up working in China’s favour. For one thing, the notion that U.S. manufacturing has been “hollowed out” is simply false. The U.S. has never manufactured more—there are just fewer humans doing it, thanks to automation, robotics, and AI.

Then there’s Vance’s sneering reference to “Chinese peasants”—a term that ignores the reality on the ground. Those so-called peasants enjoy high-speed rail, world-class infrastructure, and a level of technological integration in daily life that many Americans would struggle to imagine. I say this from personal experience: I live in China, and have spent most of my working life here. If you want to see modern infrastructure, come to Asia. Don’t take economic cues from J.D. Vance’s isolationist fever dreams.

Setting aside MAGA’s cartoonish worldview, let’s look at how the tariffs actually affect China. With a 20 per cent tariff already in place and a fresh 34 per cent slapped on top for “liberation day,” Chinese goods now face a staggering 54 per cent cumulative tariff when entering the U.S. market.

The likely outcome? Diversification. Chinese exporters, facing punitive costs in the U.S., are turning toward alternative markets. Early signals from state-affiliated social media suggest that China, South Korea, and Japan have agreed to coordinate their reciprocal tariff responses, just as they had already pledged deeper economic cooperation ahead of Washington’s latest tantrum.

If that momentum holds, China may well strengthen its regional and global trade partnerships, reducing reliance on U.S. markets and making containment efforts from Washington harder to sustain.

There’s also the inflation factor. A senior Bank of England policymaker recently suggested that, faced with these tariffs, Chinese exporters may slash prices to stay competitive—potentially contributing to a global reduction in inflation. In that scenario, the very trade war designed to kneecap China could end up boosting its global position, while helping everyone else’s bottom line.

3. Trump Tariff Impacts on the European Union.

The EU hasn’t exactly dodged the bullet. A 20 per cent tariff now hits eurozone goods bound for the U.S.—and that jumps to 25 per cent for steel, aluminium, and automobiles. But the bigger story here isn’t the tariffs themselves. It’s the realignment they may force.

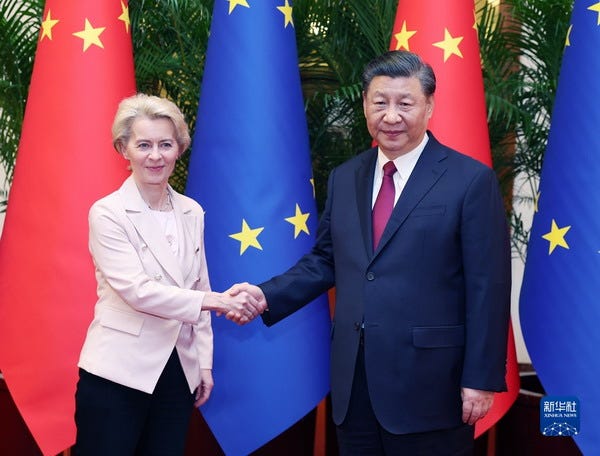

European Commission President Ursula von der Leyen, speaking to the European Parliament just days ago, pointedly referred to U.S.-EU “shared values” in the past tense. That was no accident. She pledged a reciprocal tariff response and, more tellingly, signalled a pivot: eastward. In January, von der Leyen declared that “breaking taboos” was now necessary. At Davos, she doubled down, vowing that the first trip of her new Commission would be to India. “We want to strengthen the strategic partnership with the country,” she said. Then came the real zinger: “I believe we should also strive for mutual benefits in our conversation with China.”

These are not throwaway lines—they’re signals. The EU is clearly preparing to thaw the deep freeze on China relations, with one eye on the long-stalled Comprehensive Agreement on Investment (CAI). It’s a not-so-subtle way of telling Washington: if you’re going to treat us like adversaries, don’t be surprised when we explore our options.

But such a pivot carries risk. Chief among them: a potential flood of Chinese goods into Europe, as exporters try to offset U.S. losses. Still, von der Leyen’s language suggests a willingness to reopen the door to CAI, despite the geopolitical baggage.

A Quick Refresher on the CAI

The CAI was politically agreed in December 2020, but quickly frozen in 2021—officially due to mutual sanctions over human rights. Unofficially? The Biden administration made its displeasure known. U.S. officials leaned hard on Brussels, furious that Europe dared negotiate with Beijing without Washington’s “consultation.” Jake Sullivan, then Biden’s national security adviser, tweeted that the U.S. would “welcome early consultation”—which European leaders read, quite correctly, as a patronising demand to fall back in line.

Washington got its wish. In March 2021, the U.S. roped in its loyal wingmen—the UK and Canada—to pressure the EU into joining sanctions against Chinese officials over Xinjiang. In response, Beijing hit back with counter-sanctions, including five Members of the European Parliament. And just like that, the CAI was dead in the water—another casualty of America’s insistence on staying “at the head of the table.”

Europe lost. China lost. America got what it wanted: strategic stasis.

Could the CAI Rise Again?

Trump’s tariff madness may be the catalyst that finally breaks that stasis. With the U.S. increasingly seen as an unreliable economic partner, Europe is starting to revisit old questions with new urgency.

A full revival of CAI remains unlikely—political distrust and values-based divisions haven’t disappeared. But what’s on the table now is something more modular: sector-specific agreements in green tech, digital services, or electric vehicles. Something cautious. Something conditional. But something, nonetheless, to be strongly welcomed.

In the short term, expect more defensive trade policy from Brussels—tariffs for deterrence, diplomacy through selective engagement. But longer term? Trump’s economic aggression might just push Europe and China back to the table, one sector at a time.

In Conclusion.

In the end, Trump’s tariff blitz may prove less a strategy than a trigger—one that’s accelerated the very global realignments it was meant to prevent. While flyover America braces for the economic “extreme weather” it was promised, others—Britain, China, the EU—are recalibrating, repositioning, and in some cases, reaping quiet gains. For all the MAGA rhetoric of dominance and decoupling, the practical result is a more fragmented, multipolar trade landscape where old alliances fray and new partnerships emerge—not out of shared values, but out of shared necessity. The irony? By trying to isolate America from the world, Trump may have only succeeded in isolating the world from America.

Welcome to the Eurasian century my friends.

Dean M Thomson is currently a lecturer with Beijing Normal - Baptist University (BNBU), formerly known as Beijing Normal - Hong Kong Baptist University, United International College (UIC).

My work is entirely reader-supported. To receive new posts and support my work, please consider becoming a free or paid subscriber

Alternatively why not make a one-off donation? All support is appreciated